The 8-Minute Rule for Custom Private Equity Asset Managers

(PE): investing in firms that are not openly traded. Roughly $11 (https://cpequityamtx.edublogs.org/2023/12/05/unlocking-wealth-private-investment-opportunities-with-custom-private-equity-asset-managers/). There might be a few things you do not comprehend concerning the sector.

Personal equity firms have an array of investment preferences.

Due to the fact that the most effective gravitate toward the bigger offers, the middle market is a significantly underserved market. There are extra vendors than there are very skilled and well-positioned money specialists with extensive buyer networks and resources to handle an offer. The returns of exclusive equity are commonly seen after a couple of years.

Custom Private Equity Asset Managers Fundamentals Explained

Traveling listed below the radar of large international corporations, much of these little firms frequently supply higher-quality client solution and/or particular niche services and products that are not being provided by the large empires (https://moz.com/community/q/user/cpequityamtx). Such benefits draw in the passion of private equity firms, as they have the insights and smart to exploit such chances and take the company to the next level

Private equity capitalists need to have reliable, qualified, and reputable monitoring in location. Many supervisors at profile firms are provided equity and benefit settlement frameworks that compensate them for hitting their financial targets. Such placement of goals is typically needed prior to a deal gets done. Personal equity opportunities are frequently unreachable for individuals who can not invest millions of bucks, yet they shouldn't be.

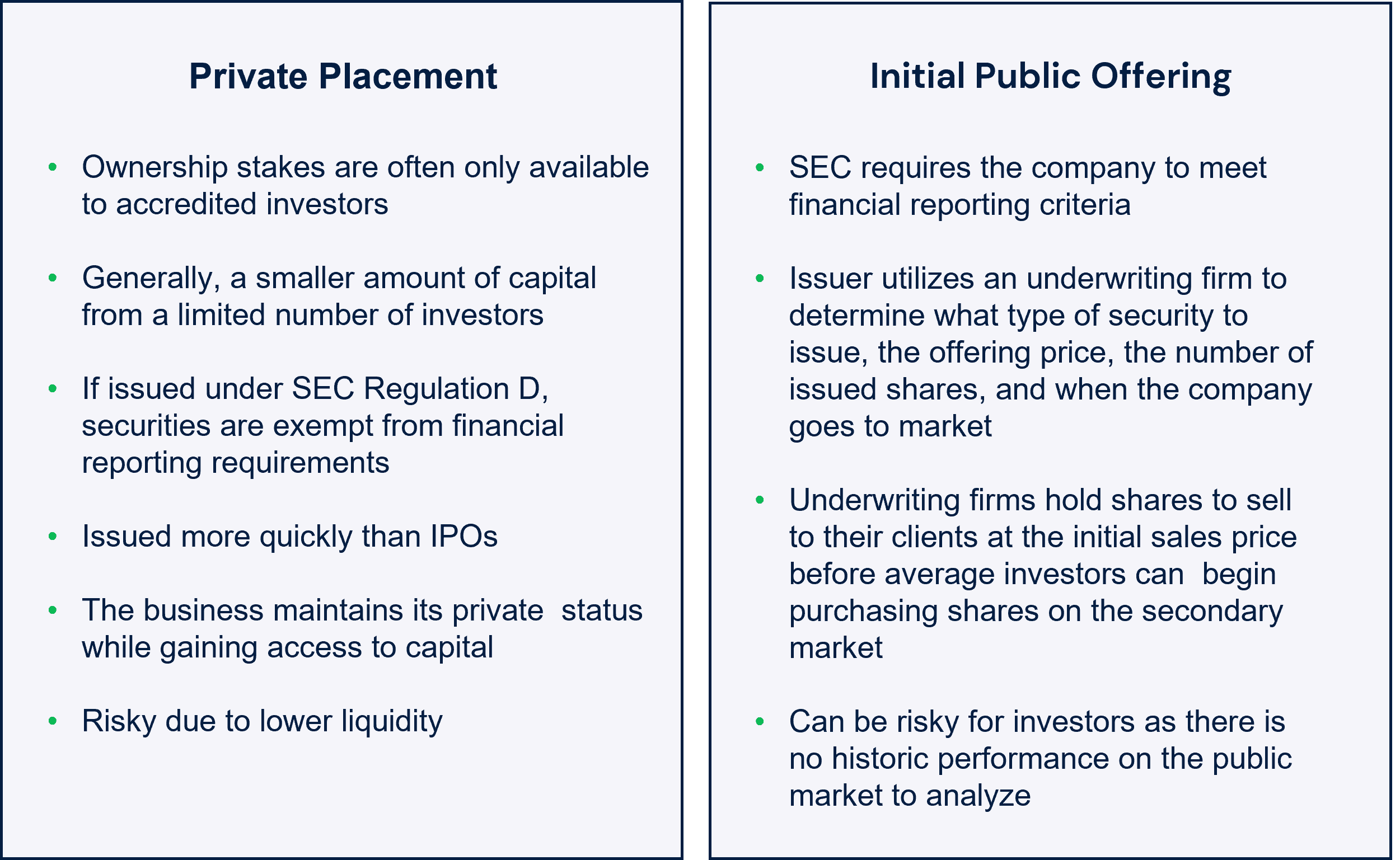

There are laws, such as restrictions on the accumulation amount of money and on the number of non-accredited capitalists. The private equity service brings in several next of the very best and brightest in corporate America, including leading performers from Lot of money 500 companies and elite administration consulting companies. Law office can additionally be hiring grounds for exclusive equity employs, as audit and lawful skills are necessary to complete bargains, and transactions are highly searched for. https://www.evernote.com/shard/s663/sh/78f8afd3-421c-a28b-04f9-3d6f5b83621f/ome7lGPiSzHoRYJQyAoDvVbVWfkAw8Jt2BLyZOMkla8rOCrlw9A55i4ORg.

The Buzz on Custom Private Equity Asset Managers

An additional negative aspect is the absence of liquidity; when in a personal equity transaction, it is not very easy to obtain out of or offer. With funds under management already in the trillions, private equity firms have actually become attractive financial investment lorries for well-off individuals and establishments.

For decades, the attributes of personal equity have actually made the asset class an appealing proposition for those who could get involved. Now that access to private equity is opening approximately more private investors, the untapped possibility is coming to be a truth. So the question to take into consideration is: why should you invest? We'll begin with the major debates for spending in private equity: How and why personal equity returns have traditionally been more than various other assets on a variety of degrees, Just how including private equity in a portfolio influences the risk-return account, by assisting to expand versus market and cyclical danger, Then, we will outline some vital factors to consider and threats for exclusive equity capitalists.

When it comes to presenting a new property into a profile, one of the most fundamental consideration is the risk-return profile of that asset. Historically, exclusive equity has actually displayed returns comparable to that of Arising Market Equities and more than all various other typical property classes. Its relatively reduced volatility coupled with its high returns produces an engaging risk-return account.

The Buzz on Custom Private Equity Asset Managers

In reality, personal equity fund quartiles have the largest variety of returns across all alternative asset courses - as you can see below. Technique: Inner rate of return (IRR) spreads computed for funds within vintage years separately and after that averaged out. Average IRR was calculated bytaking the standard of the typical IRR for funds within each vintage year.

The impact of including private equity into a profile is - as always - reliant on the portfolio itself. A Pantheon research study from 2015 suggested that including exclusive equity in a profile of pure public equity can open 3.

On the various other hand, the most effective personal equity firms have accessibility to an also bigger pool of unknown chances that do not face the same scrutiny, along with the sources to perform due persistance on them and recognize which deserve spending in (Asset Management Group in Texas). Investing at the first stage suggests higher risk, but also for the business that do prosper, the fund advantages from higher returns

See This Report about Custom Private Equity Asset Managers

Both public and private equity fund managers commit to spending a portion of the fund however there stays a well-trodden issue with lining up rate of interests for public equity fund monitoring: the 'principal-agent issue'. When a capitalist (the 'primary') hires a public fund manager to take control of their resources (as an 'agent') they entrust control to the manager while retaining ownership of the possessions.

In the situation of exclusive equity, the General Companion does not simply gain an administration cost. Private equity funds likewise reduce another kind of principal-agent problem.

A public equity financier eventually wants something - for the management to raise the stock price and/or pay out dividends. The investor has little to no control over the decision. We showed above how lots of private equity strategies - specifically bulk buyouts - take control of the operating of the company, ensuring that the long-term worth of the business precedes, pressing up the roi over the life of the fund.